Enterprising Software, Part 1: Products vs. Platforms

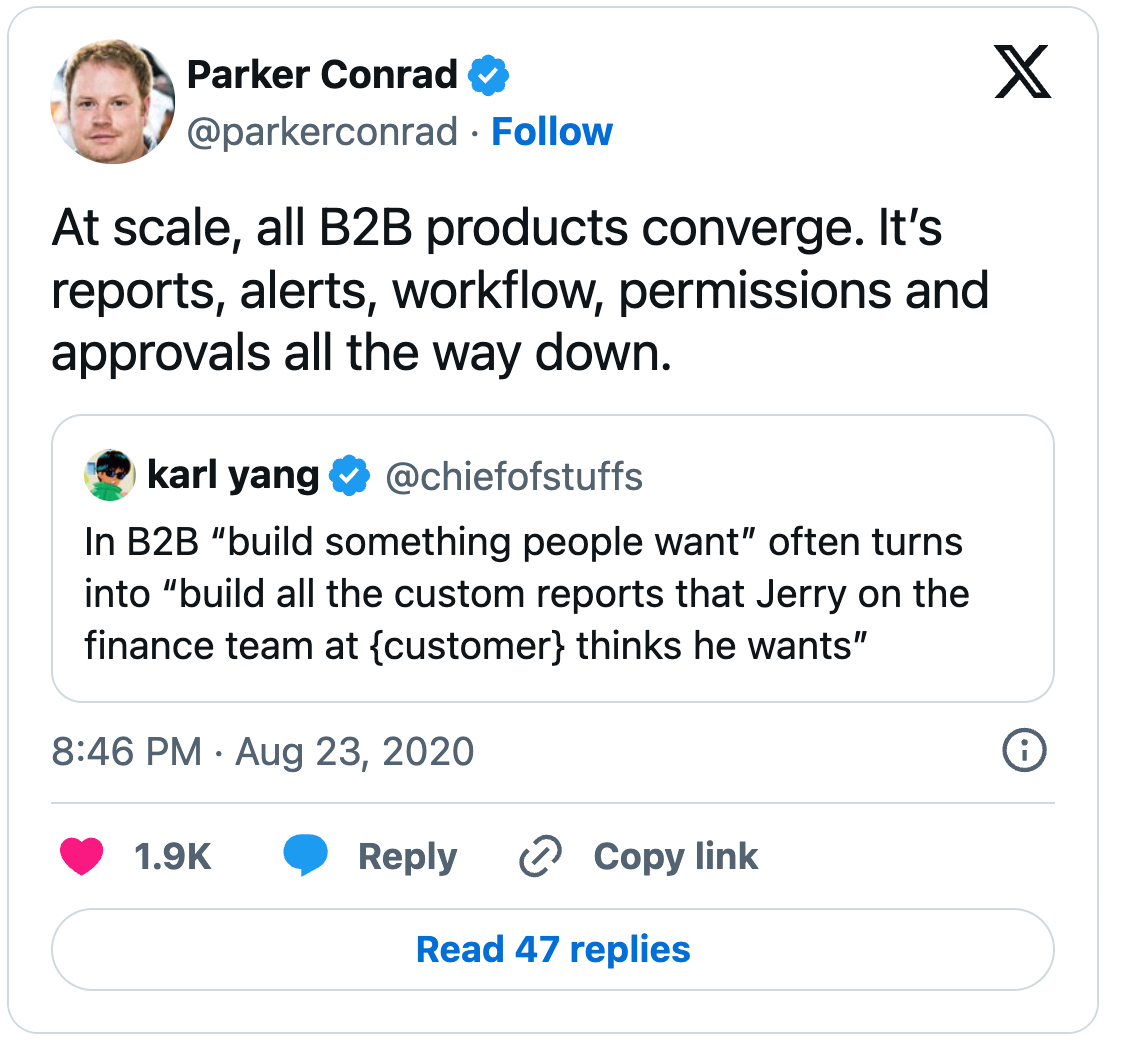

Parker Conrad, the founder of Rippling, coined the term “Compound Startup.” He proposes the idea of a B2B software platform that intentionally takes a platform approach to build a series of related products, rooted in the following principles:

Customers like everything in one place

You can build a product that is top tier (but not obviously #1); and still win the deal because you offer centralization

Being multi-product this way is a more efficient way to build (certain types of) companies — cross-selling makes go-to-market more efficient, and building shared infrastructure and components makes product & engineering more efficient

This perspective flies in the face of traditional wisdom, which is to focus and to build a wedge that customers gravitate to. This “lean” strategy also lends itself to iteration; building a compound startup is a much bigger risk. If the founder’s vision is wrong, the company is probably done. So why do a Compound startup?

If you have the credibility to raise a boatload of money, a Compound startup is the most straight-line path to build a generational company.

Generational companies are usually platforms.

Building a product (contrasted with a platform) runs the risk of getting trapped at a local maximum — and never graduating to a platform.

And if you really want to swing for the fences, targeting the untapped customer need to solve several problems in one place is a very good way to build a category-defining platform.

However, it’s not the only way.

Not-Platforms (= Product Companies)

Before we get to the different ways to build a platform, I should clarify the distinction between platforms and not-platforms.

Conventional wisdom:

Start with a “wedge,” or initial product that is quick to get adoption.

Build a “better mousetrap” — a new solution to an existing market, or identifying a narrower, better sliver to unbundle an existing solution.

If the new solution solves some critical aspect of the problem 10x better, it will get adoption.

The risk here is that the low barrier to entry. If you can do it, someone else can, too. The first-mover’s success will draw others, and probably result in a feature arms race. This makes a massive success harder. The most probable result, then, is a Product Company.

A product company is synonymous with its singular or primary offering.

Additional product lines are negligible to their revenue, and don’t necessarily compound or cement each other in a way that defends well against competition. As a result, Product Companies typically operate in a competitive market.

If the category is large enough, a product company can still be big; Dropbox, Box, Mailchimp, and Qualtrics are good examples.

Cloud storage is a particularly good example of a category that induces product companies.

Hard technical problem to solve well → which consumes all their development attention (meaning no bandwidth to build multiple products).

Feature arms race on the core product (specifically, storage and latency).

Shoe-horning a platform in is always hard; so, unsurprisingly, later attempts to extend into a platform are harder because they didn’t start out that way (e.g., Dropbox Paper).

The result is a competitive category: Dropbox, Box, Google Drive (and OneDrive, I guess).

This is not forever; product companies will seek repeatedly to make the leap to a platform. In the case of file storage, recent attempts include a) acquisitions (e.g., HelloSign & Docsend for Dropbox) and b) allowing users to run LLM workflows on top of documents.

Platforms

Contrasted with a Product Company, a Platform Company is a business that achieves durability through multiple reinforcing products or integrations

There are three paths to achieving this: Compound, Catalyst, and Composite. Each path implies different day 1 choices, core competencies, buyer personas, and failure modes.

A Catalyst Startup solves a novel problem, creating a “paradigm shift”

A Compound Startup build a multi-product suite from the get-go

A Composite Startup builds connective tissue across fragmented data / workflows

These archetypes are intermediate, not final states. Just as Product Companies seek to become Platform Companies, each flavor of Platform will naturally seek to nail multiple of these over time.

For example, a company may start as a Catalyst, then build network effects in the market to become more Composite over time. Another may start by building Composite use cases, then adding additional modules to go Compound.

Enduring technology companies (e.g., Microsoft, Google, Salesforce) have done all 3 in some order; and the best companies in the last 10 years are onto their 3rd act (Stripe, OpenAI).

Next up

Tomorrow, we’ll dive into each of the three types of companies, and the day after, we’ll analyze how market environments are more or less hospitable to each style of building.